Do you ever get to the end of the month, look at your bank account, and wonder, “Where did all my money go?”

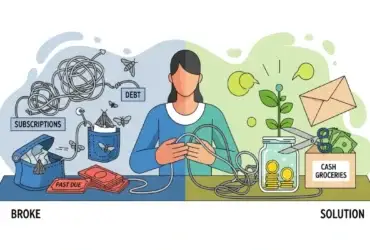

You aren’t alone. Most people spend money as it comes in, hoping there is enough left over for bills. This is called “reactive” spending.

Zero-Based Budgeting (ZBB) is the opposite. It is proactive. It stops the leaks before they happen. It is the strategy used by Fortune 500 companies and aggressive savers to maximize every cent.

If you are trying to pay off debt rapidly or save for a house, this is the most powerful tool you can use. Here is exactly how it works.

What is Zero-Based Budgeting?

There is a common misconception: Zero-Based Budgeting does NOT mean you have zero money in your bank account.

It means your Income minus your Expenses equals Zero.

The Formula:

Total Monthly Income – (Expenses + Savings + Debt Payments) = $0.00

In this system, you don’t leave $200 “floating” in your checking account. You assign that $200 to a specific category (like “Emergency Fund” or “Next Month’s Rent”). You are the CEO of your life, and you are “hiring” every dollar to do a specific job.

Why Use This Method? (The Psychology)

The 50/30/20 rule is great for beginners, but Zero-Based Budgeting is for optimization.

- It eliminates waste: When you have to assign every dollar, you realize how much you are actually wasting on subscriptions you don’t use.

- It prevents impulse buys: If you want to buy a $50 sweater, you have to look at your budget and ask, “Which category am I taking this $50 from?” It forces you to make a trade-off.

How to Start a Zero-Based Budget (5 Steps)

Step 1: Write Down Your Total Monthly Income

This isn’t your gross salary. This is what actually hits your bank account. Include:

- Paychecks (Net pay)

- Side hustle income

- Child support / Alimony

- Refunds or gifts

Example Total: $4,000

Step 2: List Your Expenses (The “Four Walls”)

Start with the essentials. If you don’t pay these, you lose your house or your health.

- Food (Groceries)

- Utilities (Lights, Water)

- Shelter (Rent/Mortgage)

- Transportation (Gas, Car note)

Example Subtotal: $2,500

(Remaining to budget: $1,500)

Step 3: List the Non-Essentials

Now, list the things you want but don’t need.

- Netflix / Spotify

- Dining Out

- Gym Membership

- Clothing

Example Subtotal: $500

(Remaining to budget: $1,000)

Step 4: The “Zero” Step (Crucial)

You have $1,000 left. In a normal budget, you might leave this alone. In a Zero-Based Budget, you must assign it.

If you have debt, assign the whole $1,000 to “Credit Card Payment.”

If you are saving, assign it to “House Down Payment.”

Your goal is to get the “Remaining” number to exactly $0.

Step 5: Track and Adjust

A Zero-Based Budget is a living document. You can’t set it and forget it.

If you overspend on Groceries by $50, you must immediately move $50 from another category (like Dining Out) to cover it. You are constantly balancing the scale to keep it at zero.

Common Pitfalls (And How to Avoid Them)

The “Variable Income” Problem:

“I’m a freelancer; my income changes every month.”

The Fix: Base your budget on your lowest earning month. If you make more, treat the extra money as a “bonus” and assign it directly to savings or debt at the end of the month.

The “Forgotten Bill” Problem:

“I forgot about my annual car registration.”

The Fix: Use Sinking Funds. Divide that $120 annual bill by 12 months. Add a line item in your monthly budget for $10/month. When the bill comes, the money is waiting.

Summary Comparison: ZBB vs. Others

| Feature | Standard Budgeting | Zero-Based Budgeting |

| Goal | “Don’t spend too much” | “Assign every single dollar” |

| Effort Level | Low | High (Requires tracking) |

| Control | Medium | Maximum |

| Best For | Casual Savers | Debt Payoff & Aggressive Savers |

Best Apps for Zero-Based Budgeting

You can use a spreadsheet, but apps make the math easier.

- YNAB (You Need A Budget): The gold standard for this method. It is built entirely around the zero-based philosophy.

- EveryDollar: Created by Dave Ramsey, this is a simpler, user-friendly option specifically for ZBB.

Final Thoughts

Zero-Based Budgeting feels restrictive at first, but it actually gives you freedom.

When you assign $100 to “Fun Money,” you can spend that $100 guilt-free because you know the rent is already paid.

Stop wondering where your money went. Tell it where to go.

Leave a Reply