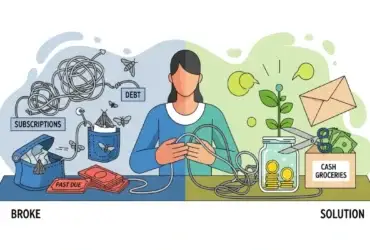

You work hard. You pay your big bills on time. You don’t buy luxury cars. Yet, at the end of the month, your bank account feels empty. Why?

It is usually not the one-time splurge that breaks a budget; it is the “Death by a Thousand Cuts.”

Silent money leaks are small, recurring expenses that fly under the radar. They seem insignificant ($5 here, $10 there), but when you do the math, they add up to thousands of dollars a year.

We identified the 12 most common financial vampires. Let’s see how many of them are currently in your wallet.

Category 1: The Digital Drains (Tech & Subs)

1. The “Zombie” Subscriptions

These are the subscriptions you signed up for, used once, and forgot about. Streaming services, premium apps, or that digital magazine you never read.

- The Leak: You think “It’s only $9.99,” so you don’t cancel it.

- The Fix: Check your bank statement for the last 90 days. If you haven’t used it in 30 days, kill it.

- Estimated Annual Loss: $240+

2. The “Free Trial” Trap

You signed up for a 7-day free trial to watch one show or use one PDF converter. You forgot to cancel. Now, you’ve been paying for six months.

- The Fix: Whenever you sign up for a trial, immediately set a calendar alert on your phone for “Cancel [Service]” one day before it expires.

- Estimated Annual Loss: $150+

3. Unchecked Cloud Storage

Are you paying for 2TB of iCloud or Google Drive storage when you are only using 50GB? Many people upgrade when they get a “Storage Full” warning and never downgrade after deleting files.

- Estimated Annual Loss: $120

Category 2: The Physical Waste (Food & Home)

4. Food Waste (The Fridge Graveyard)

This is the biggest leak for most families. You buy fresh produce with good intentions, but the spinach turns to slime before you eat it. Throwing away food is literally throwing away cash.

- The Fix: Stop shopping for the “ideal you” and shop for the “real you.” Buy frozen veggies—they last months and have the same nutrients.

- Estimated Annual Loss: $1,500 (Based on USDA averages).

5. Energy Vampires (Phantom Load)

Did you know your TV, game console, and coffee maker draw power even when they are turned off? This is called “Phantom Load.”

- The Fix: Use a Smart Power Strip. It cuts the power completely when devices aren’t in use.

- Estimated Annual Loss: $100 – $200

6. Brand Loyalty on Generics

Buying Tylenol instead of Acetaminophen. Buying Windex instead of generic glass cleaner. You are paying a “marketing tax” for the exact same chemical ingredients.

- The Fix: Look at the ingredients list. If they are identical, buy the store brand.

- Estimated Annual Loss: $300+

Category 3: The Convenience Fees (Laziness Tax)

7. Third-Party Delivery Apps

When you order a $15 burger on DoorDash or UberEats, it ends up costing $28 after service fees, delivery fees, small order fees, and tip.

- The Leak: You are paying a 100% markup for the convenience of not driving 10 minutes.

- The Fix: Delete the apps. If you want takeout, go pick it up.

- Estimated Annual Loss: $1,200 (If you order just once a week).

8. ATM Fees

Withdrawing cash from an out-of-network ATM costs about $3 to $5. It feels small, but it’s literally paying money to access your own money.

- Estimated Annual Loss: $60

9. Bottled Water

Unless you live in an area with unsafe tap water, buying bottled water is a massive markup (about 2,000% more expensive than tap water).

- The Fix: Buy a high-quality water filter and a reusable bottle.

- Estimated Annual Loss: $200+

Category 4: The Hidden Penalties

10. Late Fees

Forgetting a credit card payment by one day doesn’t just hurt your credit score; it triggers a late fee of up to $40.

- The Fix: Set every single bill to “Auto-Pay Minimum Amount.” You can always pay more later, but this ensures you never get hit with a fee.

- Estimated Annual Loss: $80

11. Low Balance Fees

Some banks charge you $10-$15 a month if your checking account drops below a certain minimum balance.

- The Fix: Switch to a modern online bank (like Ally, SoFi, or Capital One) that has no minimum balance requirements.

- Estimated Annual Loss: $180

12. Auto-Renewing Insurance

Insurance companies rely on your laziness. If you let your car insurance auto-renew every year, your rate likely creeps up.

- The Fix: Shop around every 12 months. It takes 15 minutes and often saves hundreds.

- Estimated Annual Loss: $300+

The Grand Total

Let’s do the math. If you have all 12 of these leaks, how much are you losing?

Total Potential Savings: ~$4,530 per year.

That is a vacation. That is a used car. That is a fully funded Roth IRA contribution. And right now, it is vanishing into thin air.

What To Do Next

Don’t try to fix all 12 today. You will get overwhelmed.

- Pick the “Big Three”: Food Waste, Delivery Apps, and Subscriptions.

- Audit this weekend: Sit down for 30 minutes this Saturday and plug just these three holes.

- Watch your balance grow: You will see the difference in your account within 30 days.

Leave a Reply