There is a misconception that minimalism is just an aesthetic for rich people who like white walls and empty rooms.

Real minimalism is a financial weapon.

Every item you own is not just an object; it is a drain on your time, energy, and bank account. The storage unit you rent for old furniture? That’s money. The bigger house you bought to store your clothes? That’s a mortgage. The stress of cleaning a cluttered home? That’s mental energy you could use to earn more.

When you adopt a minimalist lifestyle, you stop buying things to impress people you don’t like, and you start funneling that money into your freedom fund.

Here are 7 practical minimalist living tips to save money immediately.

1. The “Packing Party” Method (Radical Reset)

Most people try to declutter slowly. This rarely works. The creators of The Minimalists, Joshua Fields Millburn and Ryan Nicodemus, suggest a radical approach: The Packing Party.

- The Method: Pack everything you own into boxes as if you were moving.

- The Rule: Over the next 21 days, only unpack items as you need them (e.g., toothbrush, bed sheets, one frying pan).

- The Result: After 3 weeks, 80% of your stuff will still be in boxes. This proves you don’t need it. Sell the rest on eBay or Facebook Marketplace.

Why this saves money: You realize how little you actually need to be happy, which kills the urge to buy “more.”

2. Adopt a “Capsule Wardrobe”

Decision fatigue is real. Successful people like Mark Zuckerberg or Steve Jobs wore the same outfit every day not because they had no style, but to save mental energy.

From a financial perspective, a capsule wardrobe is a game-changer.

- The Strategy: Limit your closet to 30 high-quality, interchangeable pieces.

- The Math: The average person spends $161/month on clothes they rarely wear. By switching to a capsule wardrobe, you stop chasing trends.

| Standard Wardrobe | Capsule Wardrobe |

| Buys 20+ cheap items/year | Buys 3-4 high-quality items/year |

| Panic buys for events | Always has an outfit ready |

| Cost: $1,900/year | Cost: $400/year |

3. The “One In, One Out” Rule

This is the golden rule of maintenance.

If you buy a new pair of shoes, an old pair must be donated or thrown away. If you buy a new video game, you must sell an old one.

Why this works:

- It stops clutter from accumulating.

- It adds a “friction cost” to shopping. You will think twice about buying that $15 shirt if you know it means saying goodbye to your favorite old hoodie.

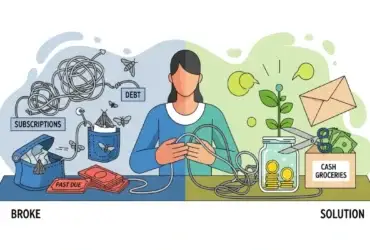

4. Practice Digital Minimalism (Subscription Culling)

Clutter isn’t just physical; it’s digital. And digital clutter drains your bank account silently.

- The Audit: Do you have Netflix, Hulu, Disney+, and Max? Do you have a gym membership you use twice a month?

- The Minimalist Fix: Rotate your subscriptions. Only pay for one streaming service at a time. Watch everything you want on Netflix for two months, cancel it, then get Hulu.

Pro Tip: Read our guide on [Internal Link: How to Save Money When Broke] for a script on how to negotiate these bills down.

5. The 30-Day “Wait List”

Impulse buying is the enemy of minimalism. Marketers are experts at triggering your “Need it Now” emotion.

The Strategy: Create a note on your phone. When you want to buy something non-essential >$50, write it down with today’s date.

- The Rule: You are not allowed to buy it for 30 days.

- The Outcome: 90% of the time, you will forget you even wanted it.

6. Stop Renting Space for Your Stuff

The ultimate cost of clutter is housing.

Do you actually need a 3-bedroom house, or do you need a 1-bedroom house and storage space for your junk?

- The Hard Truth: If you downsized to a smaller apartment/home because you owned less stuff, you could save $500–$1,000 per month in rent or mortgage. That is $12,000 a year—enough to max out an IRA.

7. Monotony in Meals (Meal Prep Minimalism)

A chaotic kitchen leads to ordering UberEats. A minimalist kitchen is efficient.

The Strategy: Don’t try to cook 7 different gourmet dinners a week. Pick 3 core meals and rotate them.

- Breakfast: Oatmeal every day.

- Lunch: Leftovers.

- Dinner: Rotate between Tacos, Stir-fry, and Pasta.

This simplifies your grocery list, reduces food waste, and stops you from buying random ingredients you’ll only use once.

Conclusion: Freedom Over Stuff

Minimalism isn’t about deprivation. It is about making room for what matters.

Every dollar you don’t spend on a new gadget or a trendy outfit is a dollar that can buy your freedom. It can go into your [Internal Link: Money Challenge Fund] or pay off debt.

Start small. Clear off one surface in your home today. Then, clear one recurring charge from your bank statement.

Leave a Reply