Let’s be honest: Most money advice is useless if you are actually struggling.

Reading an article that tells you to “max out your 401k” or “stop buying $6 lattes” feels like a slap in the face when you are trying to decide between paying the electric bill or buying groceries.

I get it.

Here is the truth: You can save money even on a razor-thin income, but you cannot do it using the standard advice designed for wealthy people. You need a survival strategy.

This guide isn’t about getting rich overnight. It is about finding breathing room when you feel like you are drowning.

The Short Answer (For Skimmers)

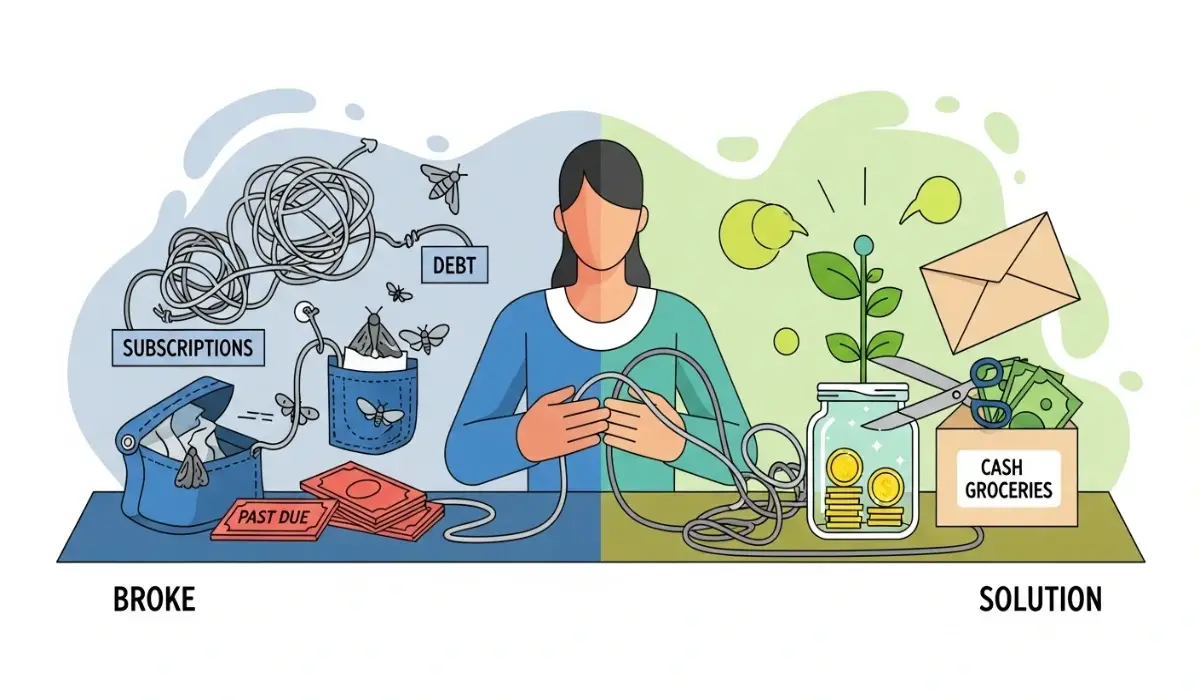

If you want to start saving immediately, follow the “3-Step Stop the Bleeding” method:

- The Audit: Print your last 3 bank statements and highlight every “ghost subscription” you forgot about.

- The Call: Call your utility and internet providers and ask for the “retention offer” (script included below).

- The Switch: Move to a cash-only grocery budget for 30 days to stop impulse swipes.

Confront the “Ostrich Effect”

Psychologists have a term for when we avoid looking at our bank accounts because it scares us: The Ostrich Effect.

You cannot fix what you cannot see.

Big banks will tell you to “make a budget.” But if you are broke, a budget feels restrictive. Instead, do a “Forensic Audit.”

- Log into your bank app right now.

- Look at the last 30 days.

- Identify exactly where the “leaks” are.

Pro Tip: Most people find they are losing $40–$100/month on small recurring charges (apps, streaming, old memberships) that they don’t even use. That $50 is the start of your emergency fund.

2. Use the “24-Hour Rule” for Impulse Buys

When funds are low, our brains crave dopamine. Buying something small feels like a reward for enduring a hard life. This is the trap.

The Rule: If you see something you want (that isn’t a necessity like food or medicine), you must wait 24 hours before buying it.

- Why it works: 90% of the urge to buy is emotional. After sleeping on it, the emotion fades, and logic returns. You will likely realize you don’t need it.

3. Negotiate Your Fixed Bills (With Script)

This is the easiest money you will ever make. Internet, phone, and insurance companies rely on your laziness. They charge loyal customers more than new customers.

You don’t need to be aggressive; you just need to be polite and persistent. Use this exact script:

| The Scenario | What to Say (The “retention” Script) |

| Internet/Cable | “Hi, I’ve been a customer for 2 years. I see a promo for new customers at $49/mo, but I’m paying $79. I’d love to stay with you, but I need to fit this into my budget. Can you match that rate so I don’t have to switch providers?” |

| Credit Cards | “I’m looking at my statement and the APR is very high. I’ve been making on-time payments. Can you lower my interest rate by 2-3% to help me pay this off faster?” |

Why this works: Customer acquisition costs these companies hundreds of dollars. Keeping you for $20 less is cheaper for them than losing you.

4. The “Cash Envelope” System for Groceries

Debit cards are dangerous because they feel like “magic money.” You swipe, and it doesn’t hurt.

When you are broke, switch your variable expenses (Groceries, Gas, Entertainment) to cash.

- Withdraw your grocery budget in cash on Monday.

- Leave the card at home.

- When the cash is gone, you eat what is in the pantry.

The Psychology: Studies show that paying with physical cash activates the “pain centers” in the brain. You will naturally spend less because it “hurts” to hand over the bills.

5. Gamify Your Savings with “No-Spend Days”

Saving feels like a punishment. You need to turn it into a game.

Challenge yourself to a “No-Spend Day.”

- The Goal: Go 24 hours spending $0.00.

- Eat leftovers. Walk instead of drive (if possible). Read a book instead of renting a movie.

- Mark it on a calendar with a big red X.

Try to get 4 “No-Spend Days” in a month. If you usually spend $20/day, that is an extra $80 in your pocket just by “doing nothing.”

6. Audit Your Pantry (The “Chopped” Challenge)

Before you go to the grocery store this week, look at your cupboards. You likely have $100 worth of food sitting there—pasta, rice, canned beans, frozen veggies.

Pretend you are on the cooking show Chopped.

- The Challenge: Make meals only using what you currently have for as long as possible.

- The Result: You might be able to skip an entire grocery trip. That is instant cash savings without earning a penny more.

7. Build a “Micro” Emergency Fund

Financial gurus say you need 6 months of expenses. When you are broke, that number is so big it’s depressing, so you save nothing.

Forget 6 months. Aim for $500.

- $500 covers a flat tire.

- $500 covers a vet visit.

- $500 keeps you away from predatory payday loans.

Once you hit $500, the stress in your chest will loosen. Then, aim for $1,000.

Final Thoughts: It’s Not About Math, It’s About Behavior

Saving money when you are broke isn’t a math problem. If it were just math, you’d already be doing it. It is a psychological battle.

Start with Step 1. Log into your bank account today. Face the numbers. It will be scary for 5 minutes, but it is the only way to take back control.

Leave a Reply