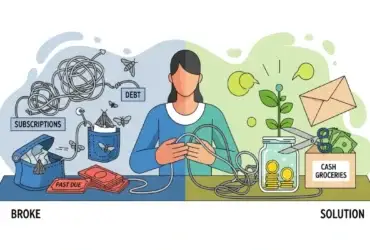

Does the word “budget” make you cringe?

For most people, a budget feels like a diet. It sounds like a list of things you can’t have. It sounds like sitting at a kitchen table with a calculator, feeling guilty about that latte you bought on Tuesday.

Let’s reframe that.

A budget isn’t a punishment; it is a permission slip. When you budget, you aren’t restricting yourself; you are simply telling your money where to go instead of wondering where it went.

If you have never budgeted before, forget complicated Excel formulas. We are going to use the “Gold Standard” method for beginners: The 50/30/20 Rule.

Here is your step-by-step roadmap to financial control.

The 50/30/20 Rule (The Short Answer)

If you want to skip the details and just start, here is the formula used by millions of experts:

- 50% Needs: Rent, groceries, utilities, minimum debt payments.

- 30% Wants: Netflix, dining out, hobbies, new clothes.

- 20% Savings: Emergency fund, retirement, extra debt payoff.

Step 1: Calculate Your “True” Net Income

Most people think they earn more than they do. If your salary is $50,000, you do not have $50,000 to spend.

- The Action: Look at your paystub, not your offer letter.

- The Number: Write down exactly what hits your bank account after taxes, insurance, and 401k deductions.

- Example: If you get paid $1,500 every two weeks, your monthly income is $3,000. This is the only number that matters.

Step 2: Categorize Your Spending (The 50/30/20 Split)

Now, we divide that $3,000 into three buckets. This prevents you from overspending on rent and having nothing left for food.

Bucket A: Needs (50%)

These are bills you must pay to survive.

- Rent/Mortgage

- Car payment & Gas

- Groceries (Not dining out)

- Utilities & Insurance

- Expert Tip: If your “Needs” are over 50% of your income, you need to lower your housing costs or earn more. You cannot “frugal” your way out of high rent.

Bucket B: Wants (30%)

This is the fun bucket. Yes, you are allowed to have fun.

- Streaming services (Netflix, Spotify)

- Dining out & Bars

- Concerts & Hobbies

- Why this matters: If you set this to 0%, you will burn out and quit. A good budget accounts for fun.

Bucket C: Savings & Debt (20%)

This is your “Future Self” bucket.

- Emergency Fund: Build a safety net (See our guide on [Internal Link: How to Save Money When Broke]).

- Debt Destruction: Extra payments on credit cards.

- Investments: Roth IRA or stocks.

Step 3: Choose Your Weapon (Tools)

You need a way to track these buckets. Don’t overcomplicate it. Pick the one that fits your personality:

| Personality | Recommended Tool | Why? |

| “The Automator” | Rocket Money / Monarch | Connects to your bank. Categorizes transactions automatically. Great if you are lazy (in a good way). |

| “The Controller” | YNAB (You Need A Budget) | The gold standard. Forces you to assign every dollar a job. Steep learning curve but life-changing. |

| “The Analog” | Google Sheets / Pen & Paper | Free. Forces you to manually type every expense, which makes you “feel” the spending more. |

Step 4: The “Sinking Funds” Secret

This is where most beginners fail. They budget for rent and food, but then—Bam!—Christmas happens. Or the car tires blow out.

A Sinking Fund is a savings account for a known future expense.

- Christmas: Save $50/month starting in January. By December, you have $600.

- Car Repair: Save $75/month. When the tires blow, you just pay cash.

- Tip: Include these in your 20% Savings bucket.

Step 5: The Weekly “Money Date”

A budget is not a “set it and forget it” tool. It is a living thing.

Schedule a recurring event on your calendar: Friday at 9:00 AM.

- Open your banking app.

- Categorize your expenses from the week.

- Ask: “Did I spend too much on dining out? Okay, I’ll cook at home next week.”

- This takes 10 minutes, but it puts you in control.

Common Beginner Mistakes to Avoid

- Being too strict: If you cut your grocery budget to $100/month, you will starve, binge-eat expensive takeout, and quit. Be realistic.

- Forgetting “Irregular” Expenses: Don’t forget quarterly bills like water, trash, or annual Amazon Prime subscriptions.

- Not adjusting: Your budget will be wrong the first month. That is normal. Adjust the numbers and try again.

Conclusion: Just Start Today

The “perfect” budget doesn’t exist. The best budget is the one you actually stick to.

Start with the 50/30/20 rule. It gives you structure without suffocating you. Once you master this, you can try advanced games like our [Internal Link: 10 Simple Money Challenges] to speed up your savings.

Your future self is begging you to start this today.

Leave a Reply