If you ask a mathematician how to pay off debt, they will scream “Avalanche!” If you ask a behavioral psychologist (or Dave Ramsey), they will scream “Snowball!”

So, who is right?

If you are staring at a pile of credit card bills, you don’t need a debate—you need a plan. The truth is, the “best” method isn’t about math. It’s about sticking to the plan.

In this guide, we are cutting through the noise. We will run the numbers on a real-world scenario to show you exactly which strategy—Debt Snowball or Debt Avalanche—will get you debt-free faster.

The Short Answer (For the Skimmers)

- Choose the Debt Snowball if you need motivation, struggle with discipline, or have many small debts. (Focus: Behavior).

- Choose the Debt Avalanche if you are analytical, disciplined, and hate seeing money wasted on interest. (Focus: Math).

The Contenders: How They Work

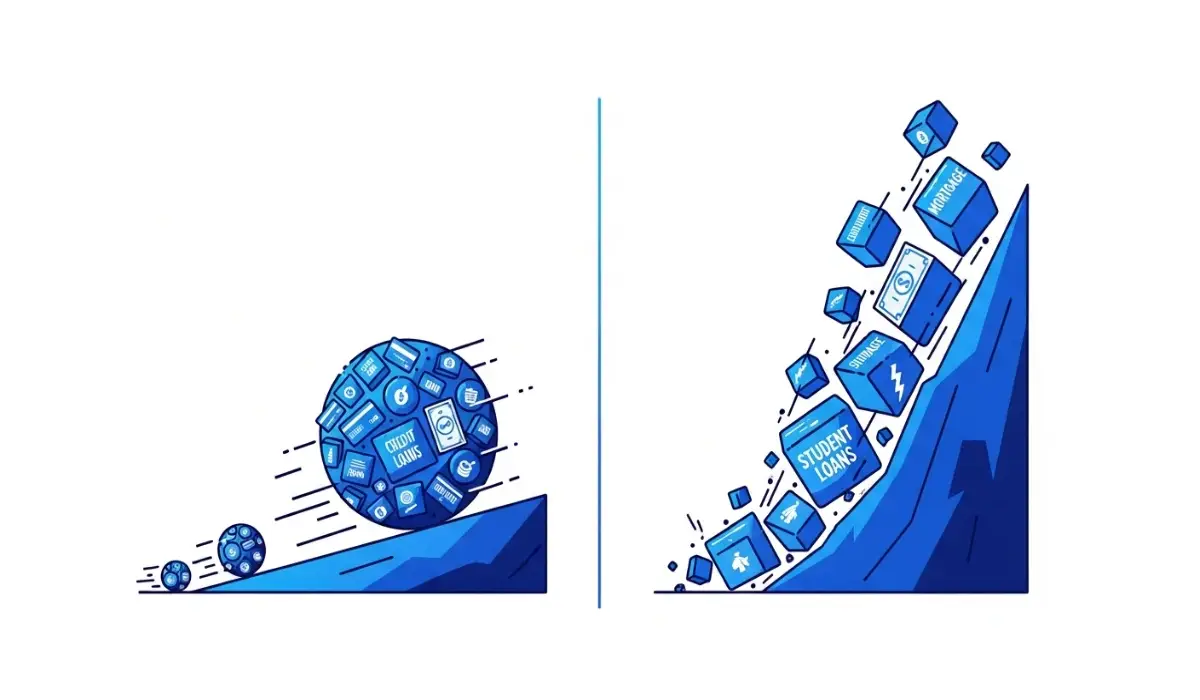

1. The Debt Snowball (The “Momentum” Method)

This method ignores interest rates completely. You list your debts from smallest balance to largest balance.

- The Strategy: You put every spare dollar toward the smallest debt while paying minimums on the rest.

- The Win: You knock out a debt quickly (maybe in month 1). You get a dopamine hit. You feel like a winner. You roll that payment into the next smallest debt.

- The Downside: You might pay more in interest over time.

2. The Debt Avalanche (The “Math” Method)

This method ignores the balance size. You list your debts from highest interest rate to lowest interest rate.

- The Strategy: You attack the debt with the highest APR (usually a credit card) first.

- The Win: You mathematically save the most money. You get out of debt slightly faster (on paper).

- The Downside: It might take 8 months to pay off that first big high-interest card. If you lose motivation in month 4, you quit.

The Case Study: “Sarah’s $15,000 Debt”

Let’s stop talking theory. Let’s look at the numbers. Imagine “Sarah” has three debts and $500 extra per month to pay them off.

| Debt Name | Balance | Interest Rate (APR) | Min Payment |

| Medical Bill | $500 | 0% | $25 |

| Student Loan | $4,500 | 6% | $50 |

| Credit Card | $10,000 | 22% | $200 |

Scenario A: Sarah uses the Snowball

She pays the Medical Bill ($500) first.

- Result: It’s gone in month 1. She feels amazing.

- Next, she attacks the Student Loan ($4,500).

- Finally, she attacks the Credit Card ($10,000).

- Total Time: 33 Months.

- Total Interest Paid: ~$3,100.

Scenario B: Sarah uses the Avalanche

She pays the Credit Card ($10,000) first because it has 22% interest.

- Result: It takes her 18 months just to pay off this first item. She sees no “wins” for a year and a half.

- Next, she attacks the Student Loan.

- Last, the Medical Bill.

- Total Time: 31 Months.

- Total Interest Paid: ~$1,900.

The Verdict on the Numbers?

The Avalanche saved Sarah $1,200 and got her out of debt 2 months faster. Mathematically, the Avalanche wins. But there is a catch…

The “Hidden Factor”: Why Math Often Fails

If the Avalanche is cheaper and faster, why is the Snowball more popular?

Because 18 months is a long time to wait for a win. In the Avalanche example, Sarah has to grind for a year and a half before she crosses a single item off her list. Most people burn out by month 6. They go back to spending.

With the Snowball, Sarah crossed an item off in Month 1. That psychological boost (“I did it!”) keeps her going.

Expert Take: The “best” diet isn’t the one with the perfect macros; it’s the one you actually stick to. The same applies to debt.

Comparison Table: Which One Fits You?

| Feature | Debt Snowball | Debt Avalanche |

| Primary Goal | Motivation & Behavior Modification | Mathematical Efficiency |

| Order of Payoff | Smallest to Largest Balance | Highest to Lowest Interest Rate |

| Interest Paid | Higher | Lower (Saves Money) |

| Risk of Quitting | Low (Quick wins keep you going) | High (Long grind before first win) |

| Best For… | Beginners, impulsive spenders | Analytical types, disciplined budgeters |

Expert Strategy: The “Hybrid” Method

Can’t decide? As a financial writer, here is the secret third option I use.

Knock out the annoyances, then switch to math.

- Step 1: Are there any debts under $1,000? Kill them immediately (Snowball style). Just get them off your brain.

- Step 2: Once the tiny gnats are gone, re-order the rest by interest rate (Avalanche style).

This gives you the immediate dopamine hit of clearing the clutter, but saves you from paying 25% APR on a massive credit card balance for years.

Final Thoughts

Don’t get paralyzed by the choice.

- If you need a hug and a cheer, pick the Snowball.

- If you own a calculator watch, pick the Avalanche.

The only wrong choice is doing nothing. Pick one, set up the autopay, and start today.

Leave a Reply