I remember the exact moment I realized I was in trouble. I was standing at a grocery store checkout, staring at the “Declined” message on the card reader.

I had $10,000 in credit card debt spread across three cards. The interest alone was eating up my paycheck. I felt suffocated.

But exactly 12 months later, I made my final payment. I didn’t win the lottery, and I didn’t get a massive inheritance. I just used a hyper-aggressive strategy that big banks won’t tell you about because they want you to stay in debt.

If you are feeling stuck, this guide is for you. Here is the exact breakdown of how I paid off $10k in one year.

The “Wake Up” Call: Knowing Your Numbers

Most people avoid looking at their statements. I was one of them. But you cannot fix what you cannot measure.

The first thing I did was create a “Debt Inventory.” It was painful, but necessary.

| Card Issuer | Balance | Interest Rate (APR) | Min. Payment |

| Card A (The Big One) | $5,500 | 22% | $150 |

| Card B (Shopping) | $3,200 | 19% | $90 |

| Card C (Emergency) | $1,300 | 24% | $40 |

| TOTAL | $10,000 | $280 |

Expert Tip: Don’t just guess. Log into every account right now and write these numbers down.

Phase 1: The Strategy (Snowball vs. Avalanche)

There are two main ways to attack debt.

- The Avalanche: Pay the highest interest rate first (Mathematically best).

- The Snowball: Pay the smallest balance first (Psychologically best).

I chose the Snowball Method. Why? Because I needed a win.

I attacked Card C ($1,300) first. I put every spare dollar toward that card while paying the minimums on the others. When I paid it off in two months, I felt unstoppable. I took that momentum and aimed it at Card B.

Note: If you are purely logical, choose the Avalanche method. But if you struggle with motivation (like I did), the Snowball method will save your life.

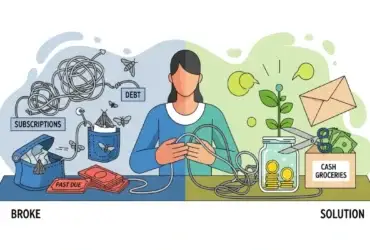

Phase 2: The “Bleeding” Stop (Cutting Costs)

To pay off $10,000 in 12 months, I needed to find roughly $833 per month. My current budget didn’t have that room. I had to create it.

Here is exactly what I cut (and what I kept):

- Ruthless Cuts:

- Streaming Services: Cancelled everything except one. (Saved $45/mo).

- Dining Out: I stopped buying lunch at work. I meal-prepped every Sunday. (Saved $200/mo).

- Gym Membership: Switched to home workouts and running. (Saved $60/mo).

- The Negotiation:

- I called my internet provider and threatened to cancel. They lowered my bill by $20/mo.

- I called my car insurance and shopped for a better rate. (Saved $30/mo).

Total Savings Found: $355/month. Still short of the $833 goal.

Phase 3: The Income Boost (Side Hustles)

You can only cut so much from your budget. Eventually, you hit zero. To bridge the gap, I had to earn more.

I didn’t start a “business.” I did “gig work” that paid immediately.

- Selling Stuff: I looked around my apartment. Old clothes, electronics, and furniture I didn’t need. I listed them on Facebook Marketplace. First month profit: $400.

- Freelancing: I used my day-job skills (writing/admin) to pick up small gigs on Upwork.

- DoorDash: On Friday and Saturday nights, instead of going out and spending money, I delivered food. Average earnings: $200/weekend.

Total Extra Income: ~$600/month.

Phase 4: The Weekly Ritual

This was the secret sauce. Every Friday, I had a “Money Date” with myself.

I didn’t wait until the end of the month to pay my credit card. As soon as money hit my checking account (from a paycheck or a side hustle), I transferred it to the credit card immediately.

This lowered my average daily balance, which slightly reduced the interest charged. But more importantly, it prevented me from spending that money on things I didn’t need.

The Result

It wasn’t easy. There were months I wanted to quit. There were weekends I missed out on parties.

But 12 months later, I sent that final payment. The feeling of seeing $0.00 on all three accounts was worth every sacrifice.

Key Takeaways for You

If you want to replicate my results, here is your checklist:

- Face the Truth: List all your debts, interest rates, and minimums.

- Pick a Strategy: Snowball (momentum) or Avalanche (math).

- Go on a Spending Fast: Cut everything non-essential for a set period.

- Earn More: Use gig apps or sell items to speed up the process.

You can do this. It starts with the first payment.

Leave a Reply