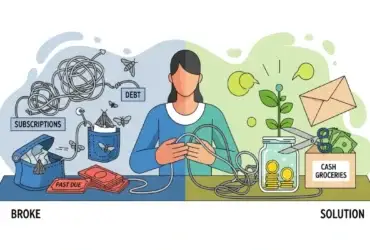

Is your bank account draining faster than you can refill it? You are not alone. With the cost of living rising in 2025, the average household is spending $3,000+ annually just on “phantom” expenses they don’t even enjoy.

The good news? You don’t need to live in a dark room or eat instant noodles to fix it. Most household leaks are invisible—until you know where to look.

In this guide, I have compiled 50 super easy ways to cut household expenses, categorized by “Big Wins” (High Impact) and “Quick Fixes” (Low Effort).

What Are Household Expenses?

Household expenses are the recurring costs required to run a home and support the people living in it. These fall into two categories: Fixed Expenses (Mortgage, Rent, Insurance) and Variable Expenses (Groceries, Utilities, Entertainment).

Expert Note: Most people try to cut “Fixed” expenses first. That is a mistake. The fastest way to save cash is tackling the “Variable” expenses where you have 100% control.

Phase 1: The “Silent Killers” (Groceries & Food Waste)

According to 2024 statistics, the average family throws away nearly 30% of the food they buy. That is like walking out of the grocery store with 3 bags and dropping one in the parking lot.

- The “Reverse Meal Plan”: Don’t plan what you want to eat. Open your pantry, look at what you have, and Google “recipes with [ingredient x].”

- Stop Buying “Convenience” Tax: Pre-cut fruit and shredded cheese cost 40% more than the whole version. Spend 2 minutes cutting it yourself.

- Use the “Unit Price” Hack: Look at the tiny print on the shelf tag (price per ounce). The bigger box isn’t always cheaper.

- The “Meatless Monday” Rule: Meat is often the most expensive item on a receipt. Swapping one dinner a week for a veggie option saves ~$50/month.

- Buy Generic “Base” Ingredients: Flour, sugar, salt, and spices are chemically identical whether they are branded or generic.

- Don’t Shop Hungry: It sounds like a cliché, but studies show hungry shoppers spend 64% more on “non-essential” items.

- Freeze Your Bread: We throw away millions of loaves a year. Keep it in the freezer and toast slices as needed.

- Grow “Regenerative” Scraps: Green onions and lettuce can be regrown in a glass of water on your windowsill for free.

- Audit Your “Phantom” Coffees: If you buy a $5 coffee every workday, that’s $1,200 a year. Buy a high-end $100 coffee machine; it pays for itself in one month.

- Use “Cash Back” Apps: Apps like Fetch or Ibotta give you 1-3% back on groceries you were going to buy anyway.

Phase 2: The “Energy Vampires” (Utilities & Bills)

Your appliances are stealing money from you while they sleep. Here is how to stop the bleed.

- Kill the “Phantom Load”: TVs, consoles, and chargers draw power even when off. Plug them into a Smart Power Strip to cut power fully when not in use.

- Wash Clothes in Cold Water: 90% of a washer’s energy goes to heating water. Cold water cleans just as well for daily loads.

- Lower the Water Heater: Most heaters are set to 140°F (scalding). Turn it down to 120°F to save 10% on heating costs.

- Air Dry Dishes: Turn off the “Heat Dry” setting on your dishwasher. Open the door and let physics dry them for free.

- Install a Geofencing Thermostat: Don’t just get a programmable one. Get one that detects when your phone leaves the house and turns off the AC automatically.

- Seal the “Drafts”: Light a candle and walk by your windows. If the flame flickers, you have a leak. Use simple caulk or weatherstripping.

- Use Wool Dryer Balls: They bounce around, separate clothes, and reduce drying time by 25%.

- LED Swap-Out: If you still have one incandescent bulb, it’s costing you 5x more than an LED.

- The “Shower Song” Timer: Limit showers to the length of two songs (approx 6-7 mins).

- Check for “Toilet Leaks”: Put a drop of food coloring in the toilet tank. If it appears in the bowl without flushing, you have a slow leak costing you money.

Phase 3: The “Subscription Audit” (Digital Waste)

The average user has 3.5 subscriptions they have forgotten about.

- The “One Screen” Rule: Downgrade your Netflix/Hulu plan to 1 screen (Standard) instead of Premium (4K/4 screens) if you live alone.

- Rotate Services: Do not pay for Netflix, Disney+, and Max simultaneously. Subscribe to one, watch everything you want, cancel, and switch.

- Call to Cancel (The Bluff): Call your internet provider and say “I am thinking of switching to [Competitor].” They often have “retention offers” ready to drop your bill by $20/month.

- Audit Your Cloud Storage: Are you paying $2.99 for iCloud/Google One? Delete old screenshots and videos to drop back to the free tier.

- Kill the Gym Membership: If you haven’t gone in 30 days, cancel it. Use YouTube workouts or run outside until you prove you can stick to a routine.

- Check Your Phone Data: Most people pay for “Unlimited” but use less than 10GB. Switch to a prepaid carrier (MVNO) like Mint or Visible for half the price.

- Unsubscribe from Marketing Emails: They are designed to trigger “Impulse Buys.”

- Library Cards > Amazon Kindle: Most libraries connect to the Libby App, letting you rent ebooks and audiobooks for free.

- Share Family Plans: Spotify and Apple Music allow up to 6 people. Split the cost with friends/family.

- Review Bank Statements Manually: Apps miss things. Scan your statement for “mystery charges” of $4.99 or $9.99.

Phase 4: The “Psychological Hacks” (Behavioral Changes)

Saving money is 20% math and 80% psychology.

- The “30-Day Rule”: If you want to buy something over $50 (that isn’t a necessity), wait 30 days. 90% of the time, the urge will pass.

- Use the “Envelope Method”: Take out cash for your weekly “Fun Money.” When the envelope is empty, you stop spending. It hurts more to hand over cash than swipe a card.

- Unsave Credit Cards from Browsers: Make yourself stand up and get your wallet every time you want to buy something online. The friction prevents laziness-buying.

- Calculate Cost in “Hours Worked”: Is that $100 dinner worth 5 hours of sitting at your desk?

- The “No-Spend” Weekend: Challenge yourself to do free activities (hiking, reading, board games) one weekend a month.

- Zero-Based Budgeting: Every dollar must have a job (Rent, Savings, Food). If you have $100 left over, move it to savings immediately so it doesn’t “disappear.”

- DIY Cleaning Products: Vinegar and Baking Soda clean better than most $6 chemical sprays.

- Repair Before Replace: A hole in a shirt or a broken toaster latch can often be fixed with a $5 kit rather than a $50 replacement.

- Buy Used High-Quality: A used solid-wood table from Facebook Marketplace will outlast a new particle-board table from IKEA.

- Drink More Water: Soda and Juice are expensive habits. Water is free (and healthier).

Phase 5: The “Last Resort” (Extreme Measures)

- House Hacking: Rent out a spare room or even storage space in your garage.

- Refinance High-Interest Debt: Move credit card debt to a 0% Balance Transfer card.

- Sell the Second Car: If you work from home, do you really need two vehicles paying insurance and maintenance?

- Cut Your Own Hair: For simple trims or buzz cuts, a $30 clipper set saves $300/year.

- Batch Your Errands: Save gas by doing all driving on one specific day of the week.

- Check Insurance Rates Annually: Loyalty doesn’t pay. Shop your car insurance every renewal; new customers get better rates.

- DIY Gifts: A framed photo or baked goods often mean more than a generic store-bought gift.

- Stop Buying Paper Towels: Use microfiber cloths that can be washed and reused 500 times.

- Challenge Your Property Tax: In many countries, you can appeal your home’s tax assessment if you think it’s too high.

- Automate Savings: Have your bank auto-transfer money to savings the day you get paid. You can’t spend what you don’t see.

Frequently Asked Questions (FAQ)

What is the biggest household expense?

For most people, Housing (30-40%) is the biggest expense, followed closely by Transportation and Food. While you can’t easily change your rent/mortgage, Food is the easiest category to cut immediately.

How does the 50/30/20 rule help save money?

This rule suggests spending 50% of income on Needs, 30% on Wants, and 20% on Savings. If your “Needs” are over 50%, you must cut variable expenses like utilities and groceries to get back on track.

Is it better to save money or pay off debt?

Mathematically, if your debt interest rate (e.g., Credit Card at 22%) is higher than your savings interest rate (e.g., Bank at 4%), pay the debt first. It is an immediate “guaranteed return” on your money.

The Verdict

Cutting household expenses doesn’t mean making your life miserable. It means cutting the waste so you can spend money on what actually matters.

Start small: Pick just 3 tips from this list to apply this week.

- My recommendation? Start with #11 (Smart Strips) and #23 (Call to Cancel). They take 10 minutes and save you money every single month forever.

Leave a Reply