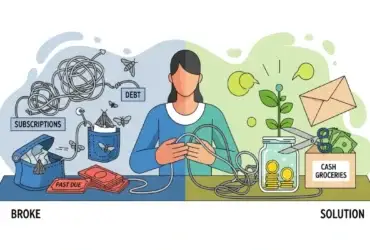

I used to look at my bank account on the 25th of every month and wonder, “Where did it all go?”

I wasn’t buying luxury cars or designer bags. I was bleeding money through what I call “Silent Leaks” small, $5 to $20 purchases that feel insignificant in the moment but destroy your budget in the aggregate.

When I finally audited my spending, I realized I didn’t need a higher salary; I needed to stop buying things that didn’t bring me value.

By cutting these 21 specific items, I clawed back over $500 every single month. Here is the exact list of things I stopped buying, broken down by category.

The “Food & Drink” Leaks (Saved: ~$220/mo)

The biggest drain on my wallet wasn’t rent; it was convenience. Here is what I cut:

1. Pre-Cut Produce I was paying $6 for a container of cut watermelon when a whole melon cost $3. I stopped paying for the “convenience tax” of 5 minutes of chopping.

2. Brand Name Spices I switched to buying spices in bulk bags or generic brands. A jar of generic cumin is $2; the branded version is $6. The taste is identical.

3. The “Work Lunch” Habit I didn’t go extreme, but I stopped buying lunch every day. Bringing leftovers 3 times a week saved me roughly $45 a week ($180/month).

4. Bottled Water I bought a high-quality water filter pitcher and a reusable metal bottle. I haven’t bought a plastic water bottle in two years.

5. Single-Serving Snacks Those small bags of chips or cookies cost 3x more per ounce. I now buy the “family size” bag and portion it out into reusable containers myself.

6. Coffee Pods (K-Cups) I realized K-Cups were costing me about $0.75 per cup. I switched to a French Press and ground coffee ($0.15 per cup).

7. Paper Towels This sounds small, but I was using 3 rolls a month. I bought a pack of microfiber cloths on Amazon for $15. I wash and reuse them. Total paper towel spend is now $0.

The “Subscription & Digital” Traps (Saved: ~$110/mo)

We live in the era of “Death by Subscription.” I audited my recurring charges and found money I didn’t know I was spending.

8. Multiple Streaming Services I had Netflix, Hulu, Disney+, and HBO. I realized I can only watch one at a time. Now, I rotate them. I subscribe to one, watch what I want, cancel, and switch.

9. Unused Gym Memberships I was paying $40/month for a gym I visited twice. I cancelled it and switched to free YouTube workout channels and running outside.

10. Audiobooks (Full Price) I stopped buying credits on Audible. I now use the Libby App, which connects to my local library card and lets me download audiobooks for free.

11. Cable TV This is obvious, but cutting the cord saved me $80 instantly.

12. In-App Purchases I removed my credit card info from my phone. No more $1.99 purchases for extra lives in mobile games or premium app filters.

The “Household & Vanity” Cuts (Saved: ~$170/mo)

13. Dryer Sheets I learned they aren’t actually necessary for clean clothes. I switched to reusable wool dryer balls. They last for years.

14. Disposable Razors I bought a safety razor handle (metal). The replacement blades cost pennies compared to the $20 cartridges from big brands.

15. Fast Fashion (Trendy Clothes) I stopped buying “going out” tops that I would only wear once. If I can’t wear it with at least 3 other items I own, I don’t buy it.

16. Salon Manicures I was spending $40 every two weeks. I learned to do a basic manicure at home.

17. Brand Name Cleaning Supplies Vinegar, baking soda, and dish soap clean 90% of my house better than the expensive “specialty” sprays.

18. New Books I love reading, but hardcovers are $25+. I now use the library or buy used books from thrift stores for $2.

19. Late Fees This isn’t a “product,” but it’s a purchase. I set up auto-pay for everything. I stopped “buying” extensions on my bills.

20. “Just in Case” Items I stopped buying things because I might need them someday. If I don’t have an immediate use for it, it stays on the shelf.

21. Upgraded Tech I stopped upgrading my phone every two years. I now keep my tech until it literally breaks or becomes unusable.

The Math: How It Adds Up

| Category | Monthly Savings | Annual Savings |

| Food & Drink Cuts | $220 | $2,640 |

| Subscriptions | $110 | $1,320 |

| Household/Vanity | $170 | $2,040 |

| TOTAL | $500 | $6,000 |

Final Thoughts: It’s About Intent, Not Deprivation

Stopping these purchases didn’t make my life miserable. In fact, it made it less cluttered. I have less trash to take out (no water bottles), fewer bills to track (fewer subscriptions), and $6,000 extra in my pocket at the end of the year.

If you want to start, don’t try to do all 21 at once. Pick the top 3 “leaks” from this list and plug them today. Your future self will thank you.

Leave a Reply